How to Manage Late Bill Payments and Prevent Them in the Future

Missing bill payments is a hassle that no one wants to deal with. Not only does it impact your credit score and financial health, but it also takes up valuable time and energy.

Best Ways to Avoid Late Bill Payments

You can use simple strategies to ensure you pay all these crucial payments on time. Introducing changes in your lifestyle will help you quickly manage your finances and never worry about missing your obligations. Each piece of advice has the potential to provide relief in the long-term process of practising them.1. Learn Your Billing Cycle

The first step in avoiding missed payments is learning your billing cycle. The billing cycle is the time between the moment you make a purchase and the moment you are billed for it. If you purchase on June 1, you will be billed for that purchase on July 1. Therefore, you will have 30 days to pay that bill before it becomes past due.Whether the bill is a credit card or a utility bill, you must know when the bill is due. Not only does it help you stay on top of your finances, but it also eliminates the worry of forgetting a payment and incurring late fees. Remember that the first thing you should consider in budgeting your finances is being aware of your own behaviour so that you can properly evaluate the adjustments you need.2. Evaluate Your Budget

If you still don't have enough money for your bills, you can use a cash advance to cover the difference. Wagetap is a great option, as you can borrow up to $2,000 without hidden fees.

3. Remove Any Unnecessary Expenses

4. Sign up for Auto Pay

After evaluating your budget and removing unnecessary expenses, you can also opt to use autopay to ensure you always make your payments on time. This will help you avoid incurring costly late fees. You can use autopay to set up a payment plan if you have a utility bill. With this, you can avoid getting disconnected from your utility provider.A tip is to sign up for auto pay with your health insurance provider to ensure you have health insurance coverage.

5. Use Bill Reminder Software

6. Pay Your Bills in Advance

If you have a large bill coming up soon, you can make sure you have the money to pay it by doing it in advance. If you are getting ready to make a large payment, such as a car or mortgage payment, this can be helpful. You can also use this strategy if you soon have a large utility or medical bill. You can set up an account at your bank to ensure you have the money when needed.Paying off bills early can ease your worries and keep your mind at ease, as it eliminates the stress of thinking about them if you already have the means to fix them.7. Split Your Bills into Payments

8. Rely on Fast Cash in Emergency Situations

If you have missed a payment and need more money to make it up, you can use a fast cash loan to make up the difference. This type of loan is designed to get you the money you need quickly and with little hassle. Your mind could be clouded in emergencies, which tend to overwhelm you. Having a fallback such as fast cash can provide fantastic relief.However, you should pay the loan quickly so you don't have to add interest charges. This can help you avoid a negative mark on your credit report.Download Wagetap

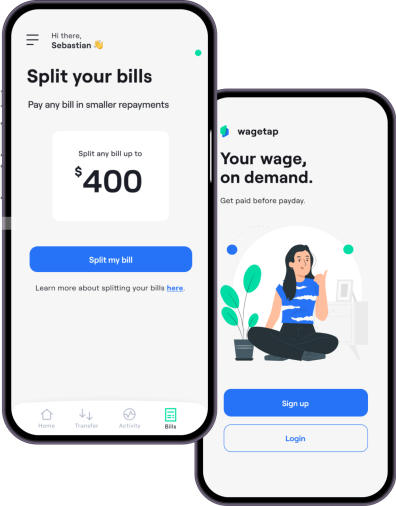

App StoreGoogle PlayIf you don't want to worry about late charges and hidden fees, you should consider downloading Wagetap. It offers a bill-split feature that can help you if you're on a tight budget. It also provides cash advances if you're in a pinch and need immediate money.For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd