Creative Ways for Paying Down Your Debt

Debt can be quite overwhelming. On top of all the other pressures, the thought of owing money to someone else can be paralysing. It doesn’t have to be. There are creative solutions to pay off debt and these proven techniques can help you eliminate them for good. With budgeting and wise spending, you can create a plan to be financially capable. Being debt-free is nice. Without debt, you can: - make more significant purchases without worrying about how you’ll pay for them; - focus on your work and save for retirement; - travel more and start investing in your future. Once you pay off your debt, the benefits are endless; - sleep easier at night knowing that your debts are paid off; - breathe a little freer knowing that your finances are in order; and - put your money to better use.

Creative Ways for Paying Down Your Debt

1. Track Your Finances

If you’re serious about getting out of debt, you must be serious about your finances. You must know where all your money is going and where it should go. And you have to stay on top of everything. Getting out of debt will take a lot of careful budgeting and spending. Be organised and make adjustments as necessary. Your bank account will thank you.2. Look for Unclaimed Funds

You can look for unclaimed funds by visiting the federal government website Moneysmart, created by the Australian Securities and Investments Commission (ASIC). ASIC is Australia's corporate, markets, financial services and consumer credit regulator that helps citizens manage their finances better.

3. Sell Your Extra Stuff

Cutting back on your spending can be helpful when getting out of debt, but it can also be a little challenging. It can be helpful to have an extra source of income to help you along the way. You can sell your extra stuff that you don’t use or need to generate some extra cash to put towards your debt. Sell your old clothes, electronics, furniture, toys, books, etc. Research how much certain items are worth so you aren’t exploited. You can look at sites like Amazon, eBay, Catch, Kogan, MyDeal, etc.It is hard to let go of things you own, especially if you are sentimental, so make sure you just let go of the things you do not value anymore.4. Use Cashback From Your Credit Card

5. Participate in Online Surveys

Online surveys can be a great way to earn to help you with your financial responsibilities. Some companies will pay you to take surveys and offer your opinion on different products, services, and more. You can make anywhere from $1 to $50 per survey, and many surveys only take a few minutes to complete.These include OpinionWorld Australia, SaySo, and MarketAgent.

6. Look Into Side Hustles

Many companies have websites with job boards where you can search for local opportunities like Indeed and Upwork.

7. Ask for a Lower Interest Rate

Getting out of debt might be challenging. You’ll likely have to make adjustments along the way as you make more progress. One way to make a big difference is to ask for a lower interest rate. You can do this by checking your credit report, ensuring all your debts are up-to-date, and ensuring your payment history is good.8. Try the Snowball Method

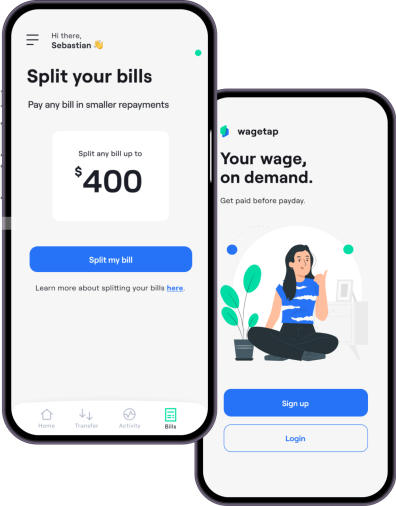

Get an Instant Cash Advance With Wagetap and Take Control of Your Finances

App StoreGoogle PlayIf you need more help to pay off your debt, you can always download Wagetap, which can act as an additional resource. It is a leading wage advance and bill split app that allows you to get your pay early. Emergencies can always happen, and Wagetap can help you handle life's unexpected expenses. It is an app designed to help Australians achieve financial independence, helping access pay early up to $2,000 and split your bills up to $600.For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd