Get Fast Cash with Our App

Nothing throws a budget out of whack like an unexpected car issue. If you need help paying for a car repair, Wagetap is your solution. When you’re needing that little bit of extra cash to get your car back on the road, use our wage advance feature to get the money you need. Wagetap is designed to reduce financial stress with our fast-cash features. If you need help with your expenses this month, make sure to download our app. Try the Wagetap app today to get access to our fast cash features and read on to find out how our app works.

Get Started with Wagetap

Instant Cash to Pay for Repairs and Breakdowns

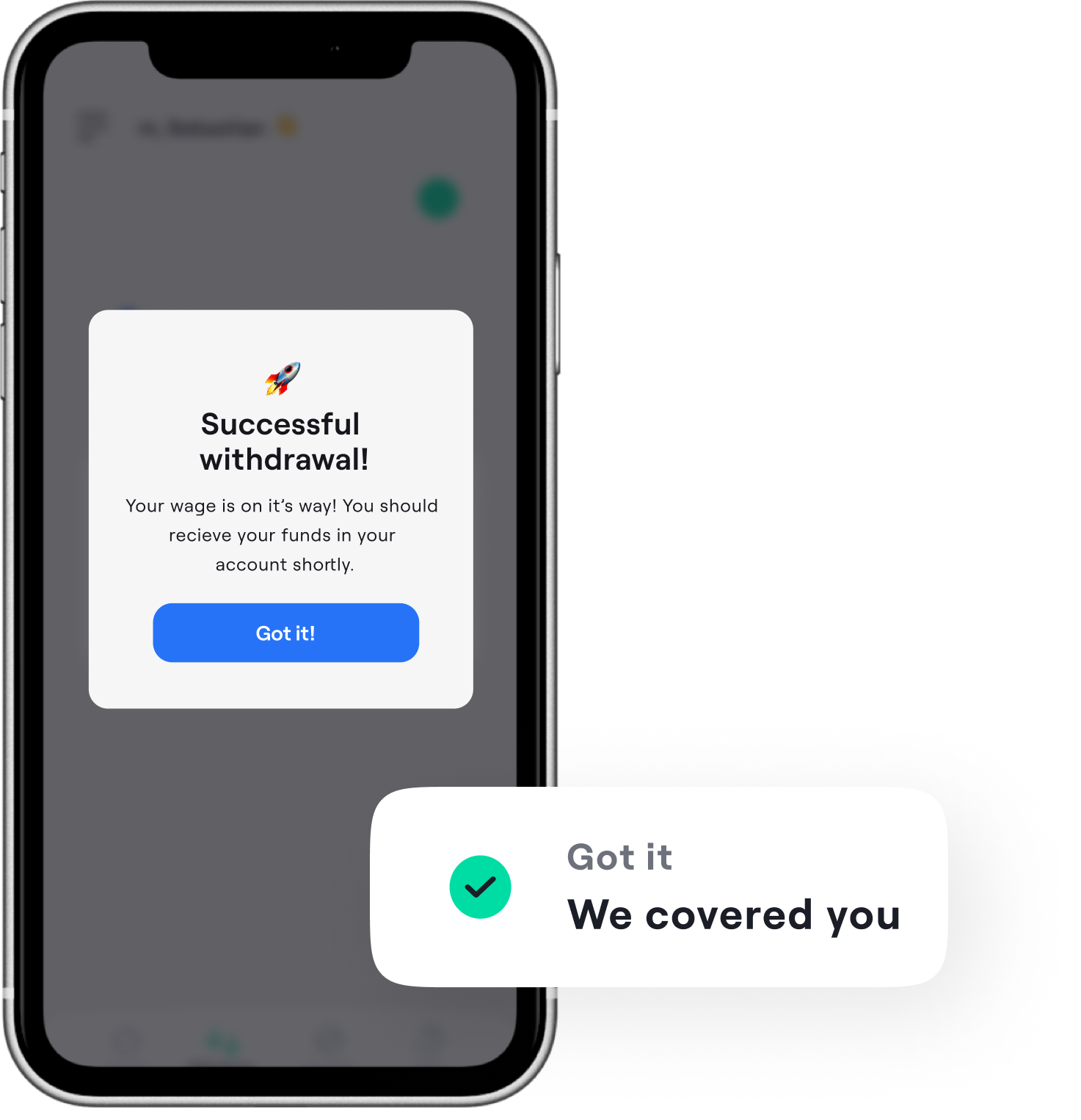

When it comes to car troubles, repairs often aren’t the only expense. You may need to get your car towed or call roadside assistance to get you back on the road. In either case, our wage advance feature has you covered. Get cash instantly sent to your account, so you can call the tow truck or roadside assistance to get the help you need. You can even use wage advances to help you cover the cost of a rental car while your car is in the shop. You’ll be back on the road in no time with Wagetap.

3 Easy Steps to Access Your Wage

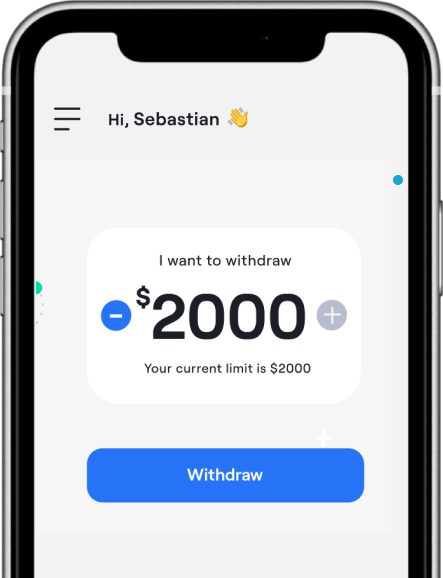

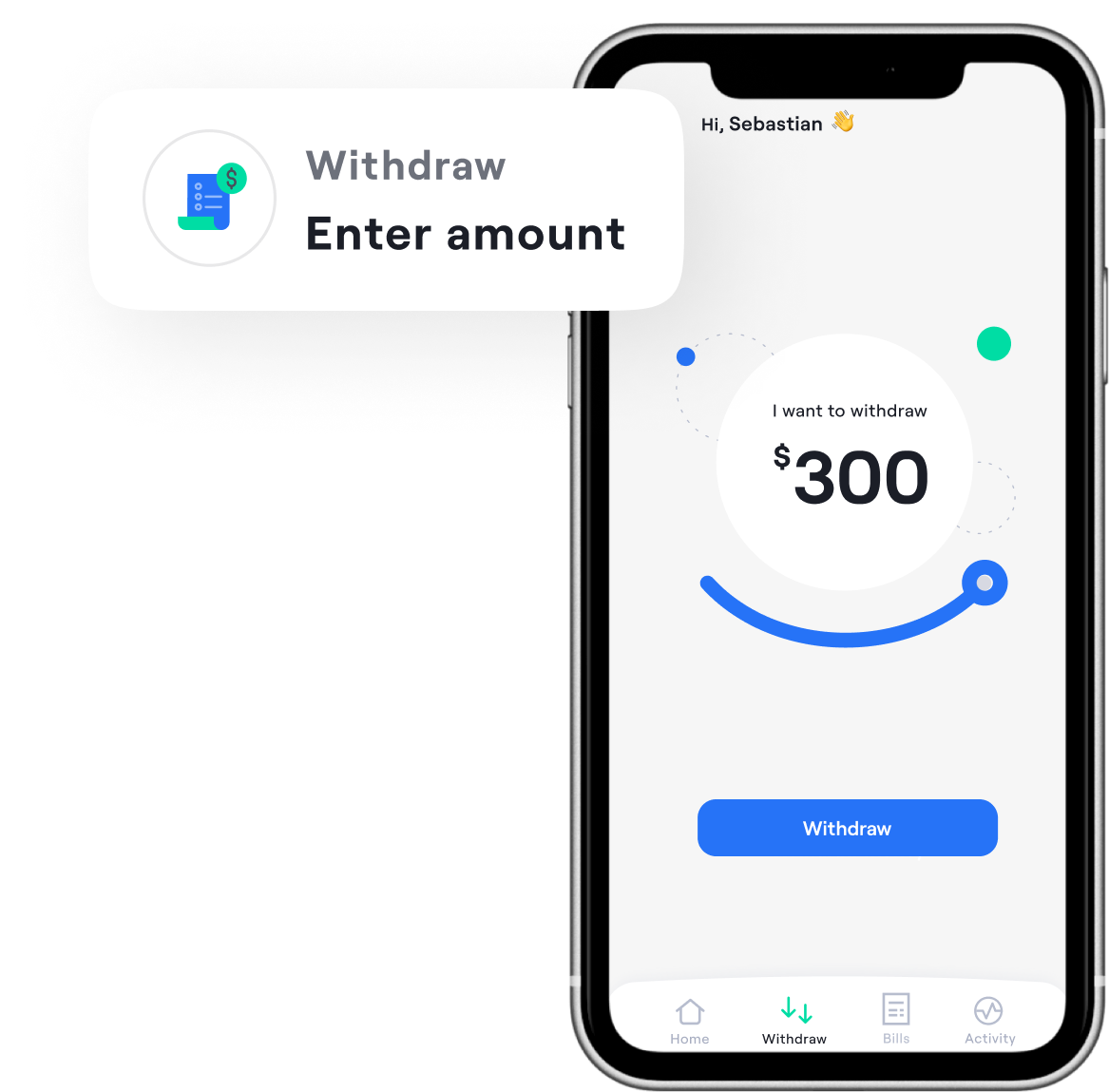

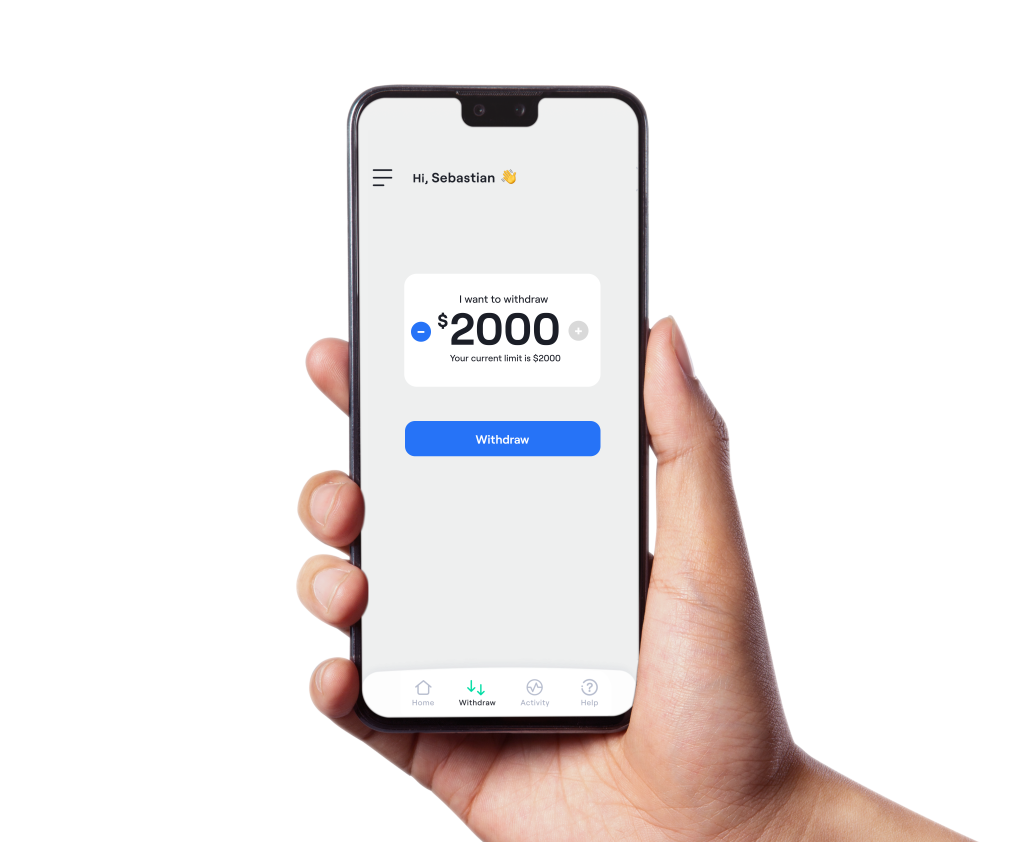

Step 1. Visit your app store and download Wagetap today. You can find our app on the Apple App Store and the Google Play Store. Easily access your wages right from your phone.

Step 2. We just need a few details to verify you, it’s fast and easy. Once you’re set up you get access to our convenient features. It’s that simple.

Step 3. Access your pay instantly for just a small fee. You don’t have to wait to access your wages. Just pay us back when your next payday comes around.

Eligibility Requirements for Assistance

It’s important to note that we do have several eligibility requirements in place for accessing our wage advance feature. If you lose eligibility, you may not be able to access these features anymore. Feel free to contact our support team if you have questions about your status.

Here are the requirements that need to be met to qualify for Wagetap’s fast-cash features:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer's payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria

Please note that we reassess user eligibility regularly.

Download Our App to Get Started!

Even well-planned budgets can be thrown off course by an unexpected car breakdown. But just because an expense is unexpected doesn’t mean you should have to miss bills to pay for it. Wagetap is here to help make sure you have the money you need when you need it most. We also offer a convenient split bill feature to help break your bills down into smaller, more manageable payments. While this feature isn’t available for car repairs, it is useful for other common bills. You can also use our bill split and wage advance features in tandem with each other. Download Wagetap today on the Apple App Store or Google Play Store. Get the financial help you need today!

It’s Like Buy Now Pay Later But for Car Repairs

Wagetap is like a buy now pay later app, except you can use it to cover your car repairs and car assistance. While buy now pay later apps are usually made for shopping expenses, Wagetap helps you with the bills and necessities of life.

See why over 300k Australians love us

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd