Fast Cash or Split Your Bill into 4 Equal Payments with Our App

Paying your council rates can be difficult, especially if you’re coming up short on funds for your payment. Missing your bill can lead to late fees and unnecessary added stress. Fortunately, Wagetap has a solution to help ease the financial burden. With our app, you can get cash fast using our wage advance feature or split your bill up into more manageable payments. Learn how our app works below and download Wagetap today to get help with your monthly bills.

Get Started with Wagetap

How it Works

Two Ways We Can Help:

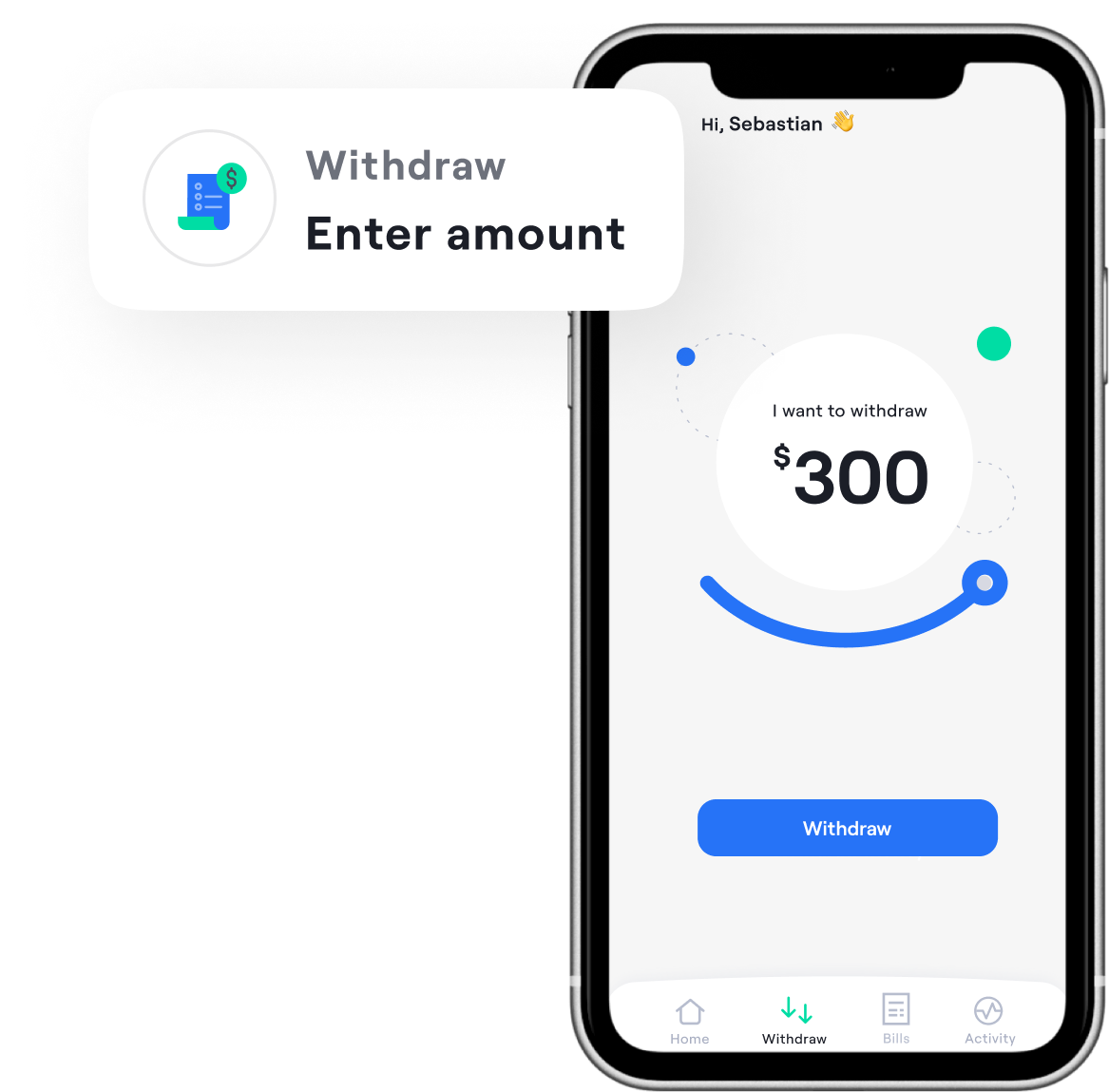

Instant Cash to Pay Your Bill

We give you two convenient options for paying your council rates bill. The first is wage advance, which allows you to borrow up to $500 of your wage before payday. This can give you some breathing room, allowing you to cover part of your council rates bill, along with any other expenses you need help with that month. Once payday comes around, you’ll get the rest of your wage. It’s that simple!

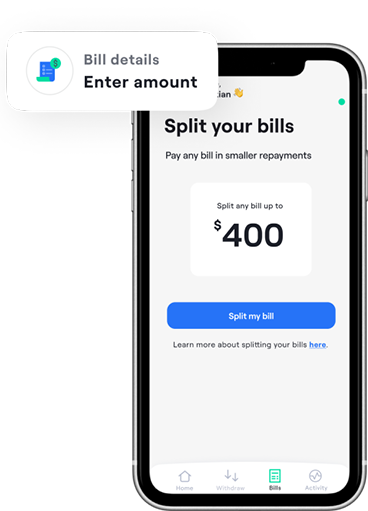

Spread Your Rates into a Stress-free Payment Plan

If you’d prefer to spread your council rates out, Wagetap offers our split bill feature. With this feature, you can split your bill up into a stress-free payment plan and cover up to $600 of your bill upfront. If you borrow less than $300 to cover your bill, your payment plan consists of three equal payments that coincide with your upcoming paydays. Borrowing over $300 will split your bill up into four payments. Of course, you can always pay early if you wish.

What Do the Charges and Fees Include?

Council rates are often charged to property owners twice per year, usually around the months of January and July. When you cover your council rates with Wagetap, your charges and fees will be going toward services such as: - Roads - Public transport - Waste collection - Parks and recreation spaces - Community facilities - Libraries With Wagetap, this bill can be split up and paid throughout the year, making it much more manageable than a lump-sum payment.

Eligibility Requirements for Council Rates Assistance

Wagetap does have certain criteria that qualify you to utilise our financial assistance. Keep in mind that eligibility isn’t permanent. You may lose access to our features if your eligibility status changes. Feel free to reach out if you have questions about your eligibility.

Here are the eligibility requirements that need to be met:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria.

We frequently reassess your eligibility to ensure you’re still able to borrow and use our features.

Download Our App to Get Started!

Ready to get your bills under control and feel more financially secure? Wagetap is easy to use and setting up your account takes just minutes. Once you’re verified, you’ll get instant access to our wage advance and split bill features. No more worrying about the council rates bill coming and not having the funds you need to cover it. Wagetap is here to help with your council rates bill, electric bill, water bill and all of your necessary expenses. Download Wagetap today from the Apple App Store or the Google Play Store to get started!

It’s Like Buy Now Pay Later But for Your Council Rates

If you’ve used buy now pay later features for shopping, then you’ll be very familiar with how our split bill feature works. The only difference is you’re covering your necessary bills instead of shopping expenses. Of course, if you need a little extra money for grocery or shopping expenses, you could always utilise our wage advance feature instead and use your money toward the things you need most.

See why over 300k Australians love us

Bill Split

What is Bill Split?

How does Bill Split work?

- 1. Add a bill within your eligibility limit

- 2. We cover your bill for you

- 3. You make smaller repayments aligned to your payday.

How much does it cost to Bill Split?

How much of my bill can I pay with Wagetap?

What affects my eligibility to use Bill Split?

- • You have not connected a transacting account that your wages are deposited. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Centrelink makes up more than 50% of your wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

How long will it take for my bill to be paid?

How many split repayments will I need to make?

- • If your bill is less than $300, your bill will be split into 3 repayments.

- • If your bill is more than $300, your bill will be split into 4 repayments.

Can I use Bill Split and Wage Advance at the same time?

How many bills can I split at a time?

Will I get a receipt for my bill payment?

Why did the bill payment get rejected?

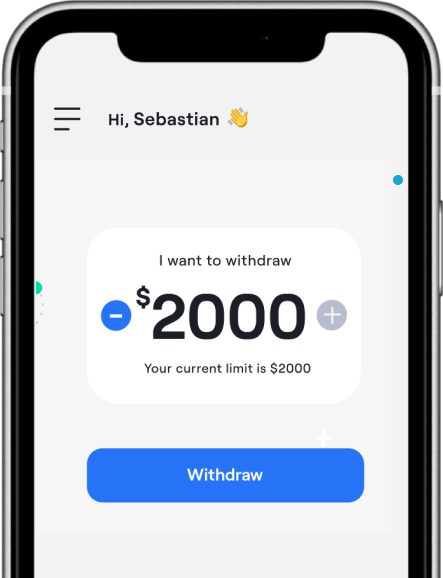

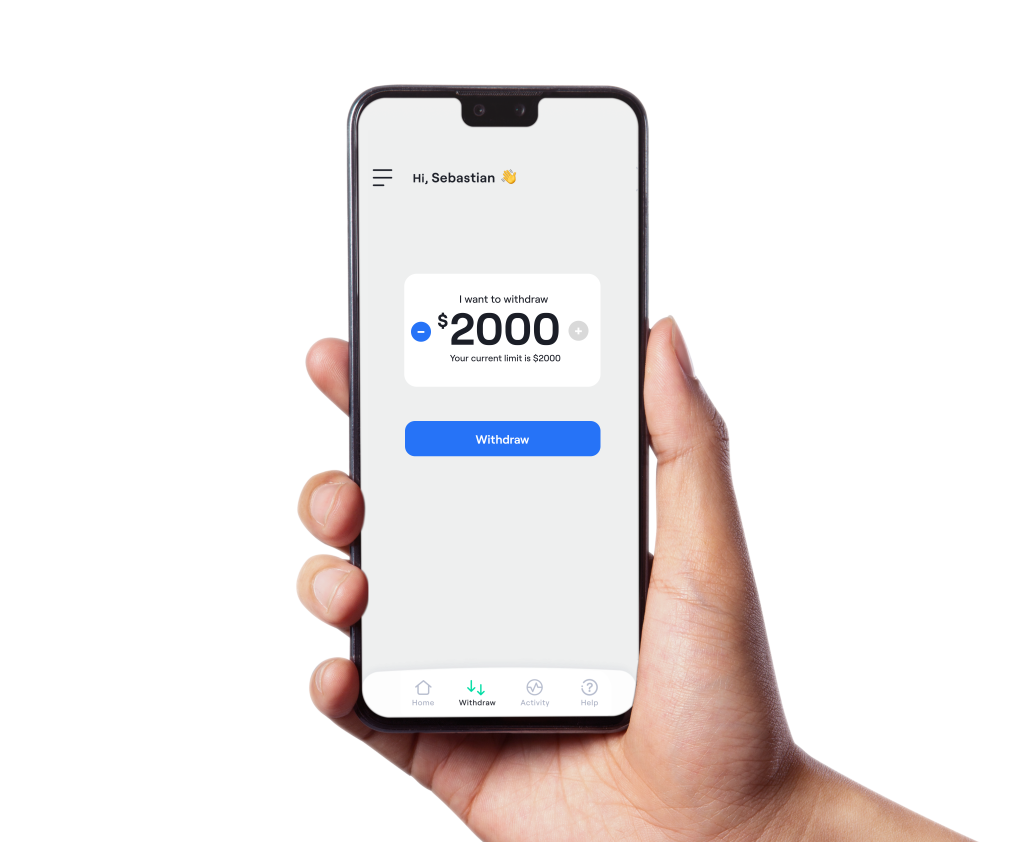

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd