Emergencies

Relieve the Stress of Unexpected Expenses

Bring forward part of your next paycheck in 3 minutes, for a fair one time fee and avoid the debt trap.

Get Fast Cash with Our App

Are you short on cash after having an emergency come up? Unexpected emergencies are stressful enough, especially when you add financial stress to the mix. Instead of worrying about the financial side of things, let Wagetap help you pay your emergency bills. With Wagetap, you can get a wage advance to cover your expenses and get the breathing room you need. Ready to leave financial stress behind? Download Wagetap today to access our features and read on to find out how it works.

Get Started with Wagetap

Instant Cash to Pay for Unexpected Emergencies

It’s impossible to predict when an emergency will happen. Even if you’ve saved up some money for emergencies, it might not be enough. Of course, there are always plenty of scenarios where you don’t have the extra cash to save for emergencies, putting you in a tough spot when one does come up.

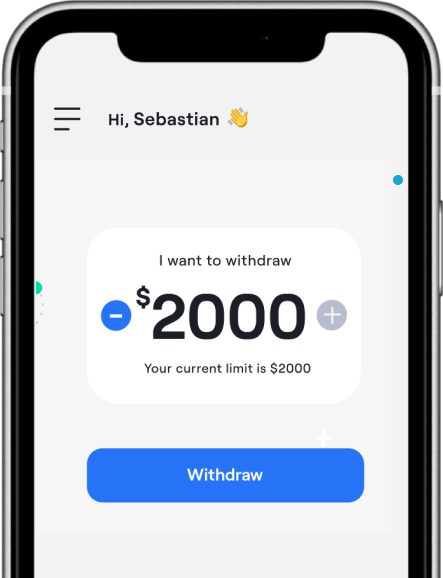

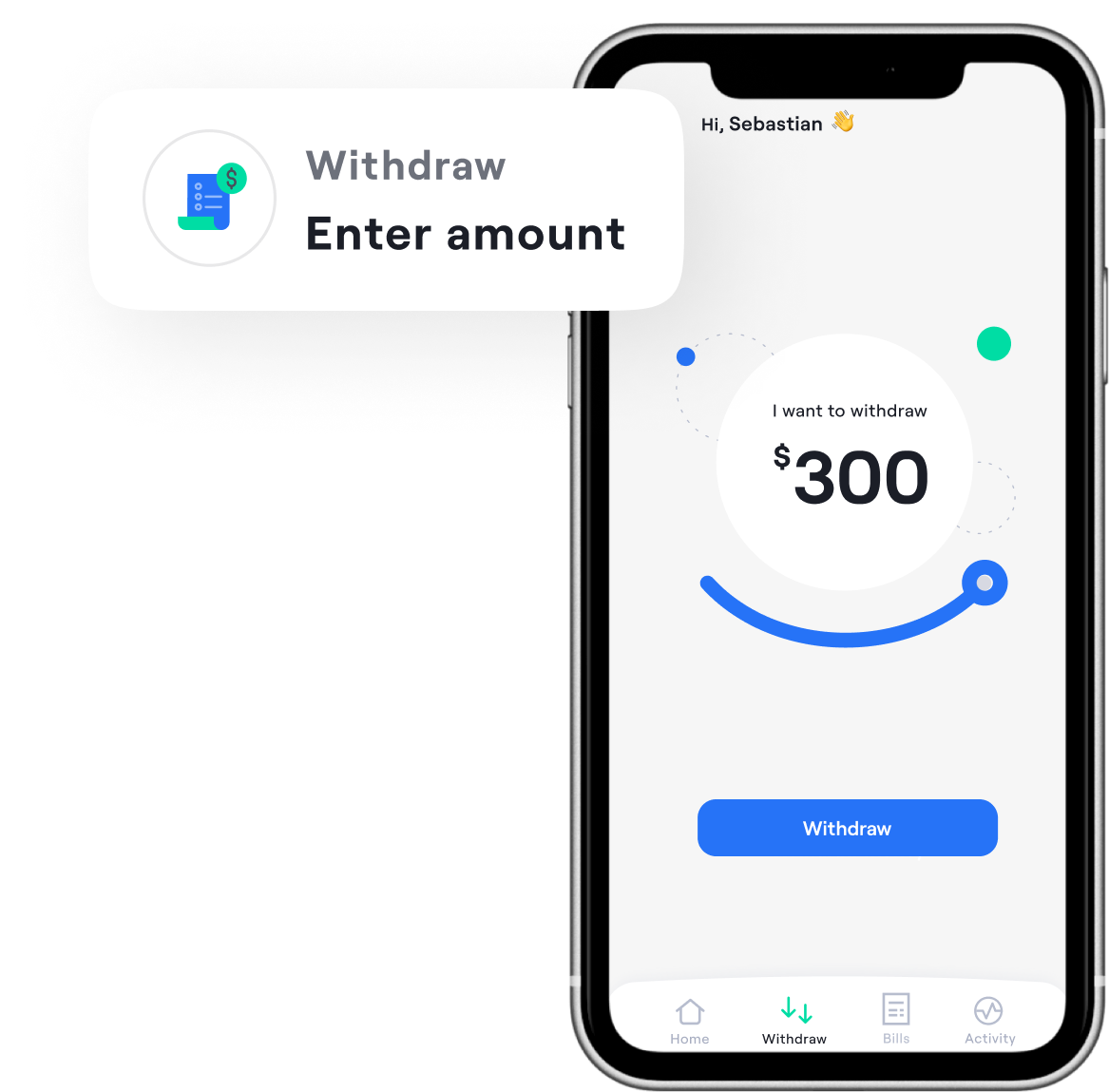

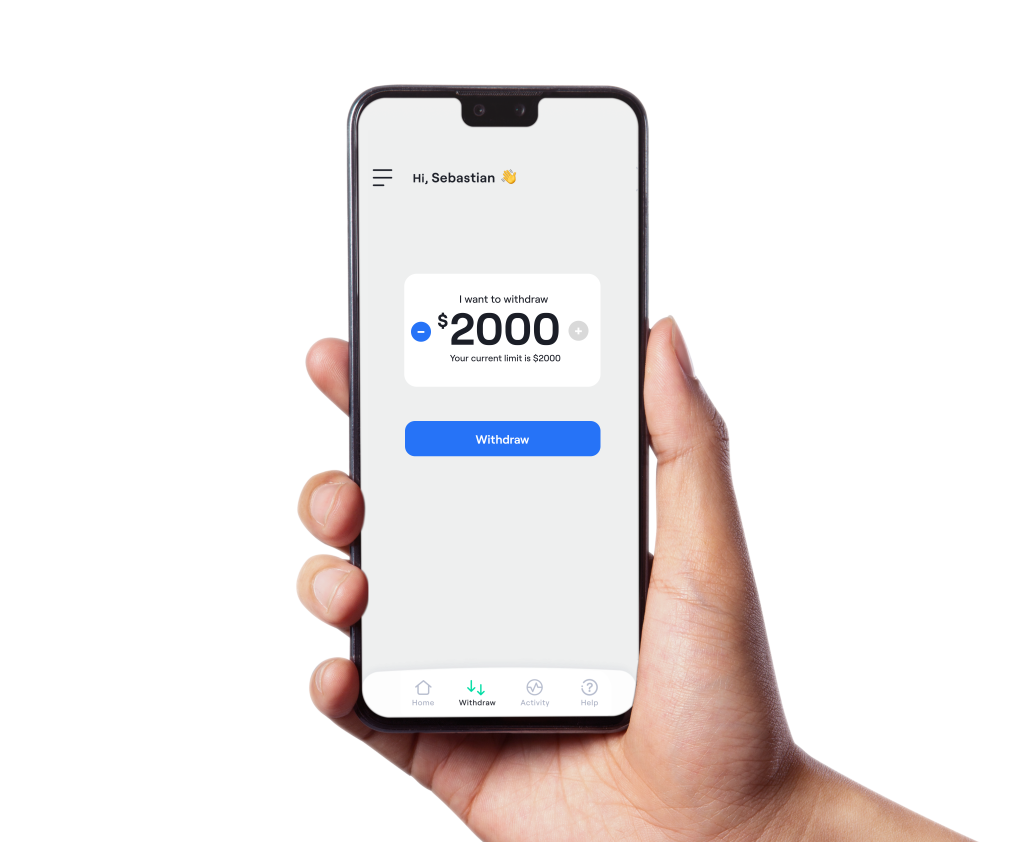

Wagetap can help with these situations. With our wage advance, you’ll get up to $2,000 of your wage when you need it most. You can use this toward the emergency, or to cover some other expenses while you deal with the emergency.

3 Easy Steps to Access Your Wage

1. Visit your app store and download Wagetap today. You can find our app on the Apple App Store and the Google Play Store. Easily access your wages right from your phone.

2. We just need a few details to verify you, it’s fast and easy. Once you’re set up you get access to our convenient features. It’s that simple.

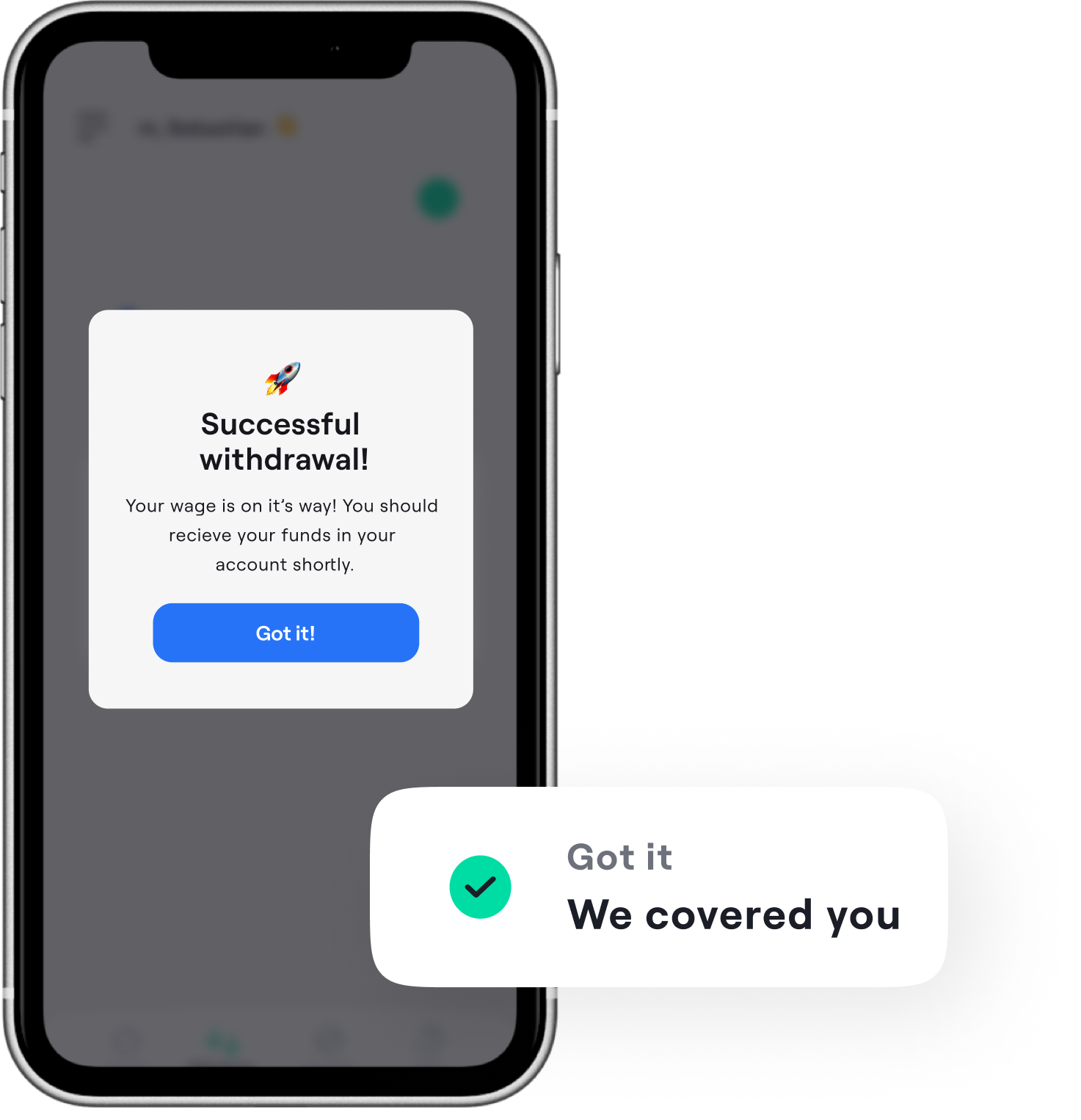

3. Access your pay instantly for just a small fee. You don’t have to wait to access your wages. Just pay us back when your next payday comes around.

Eligibility Requirements for Emergency Assistance

There are certain criteria in place to be eligible for our wage advance features. Being eligible now doesn’t guarantee your eligibility in the future. If you don’t meet one of our eligibility requirements, you may be unable to utilise our features. Please feel free to reach out to our support team if you have questions about your status.

Here are the requirements that need to be met to qualify for Wagetap’s emergency assistance features:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer's payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria

Please note that we reassess user eligibility regularly.

Download Our App to Get Started!

Emergencies can disrupt even the most carefully planned budgets. Don’t let the financial side of emergencies make a stressful situation worse. With our wage advance features, you can get that extra cash you need to help get things under control. Wagetap also has a useful split bill feature for certain common monthly bills. While you can’t use our split bill feature for emergency expenses, there are plenty of other bills that you can split into more manageable payments. You can use our wage advance feature and split bill feature at the same time to help out even more. Download Wagetap today on the Apple App Store or Google Play Store. It only takes a few minutes to set up your account and get started.

It’s Like Buy Now Pay Later But for Emergency Relief

If you’ve ever used a buy now pay later app, you’ll be relatively familiar with Wagetap’s fast-cash features. The difference is that typical buy now pay later apps are used for shopping expenses while Wagetap offers assistance for bills, emergency relief and other necessities.

See why over 300k Australians love us

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd