Fast Cash or Split Your Bill into 4 Equal Payments with Our App

Today, people need Wi-Fi and the Internet as a necessary part of everyday life. This is especially true if you work from home. But those internet bills can be costly, and a missed payment could mean your service is shut off. Instead of worrying if you have enough money for your Wi-Fi payment, just download Wagetap and cover your bills instead. Wagetap can give you instant cash with our wage advance feature or make your bill more manageable with our bill splitting feature. Interested in finding out more? Download Wagetap today and read below to learn more about how our app works.

Get Started with Wagetap

How it Works

Two Ways We Can Help:

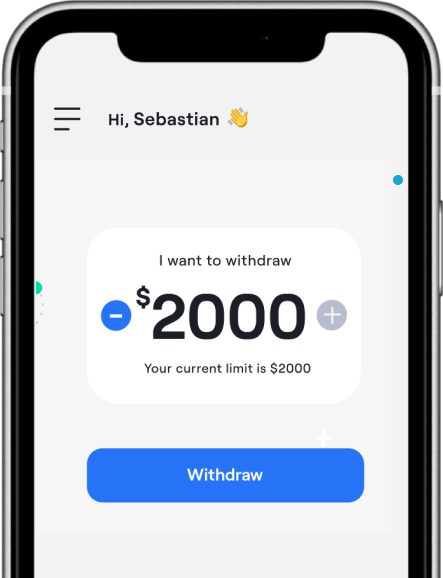

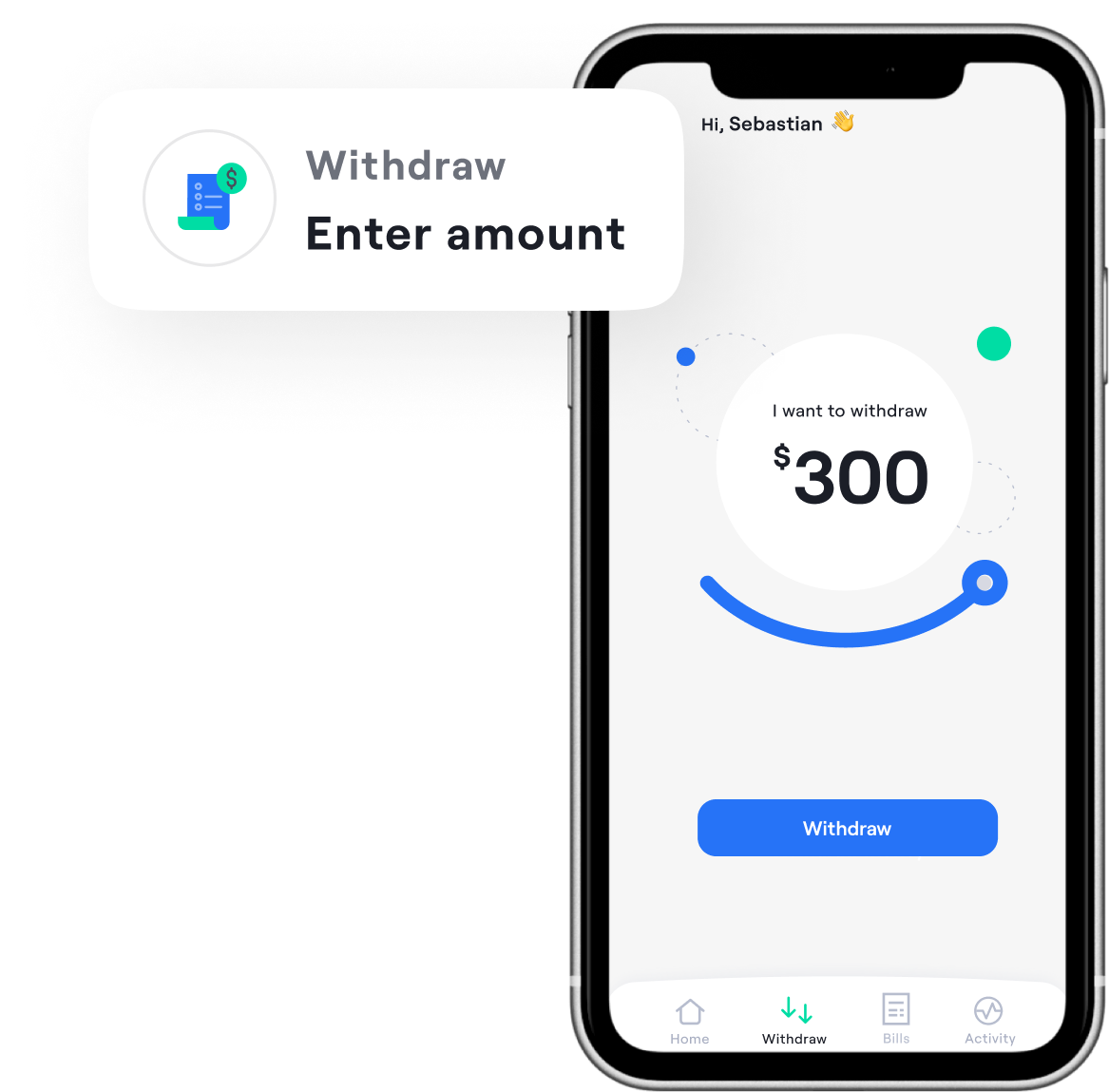

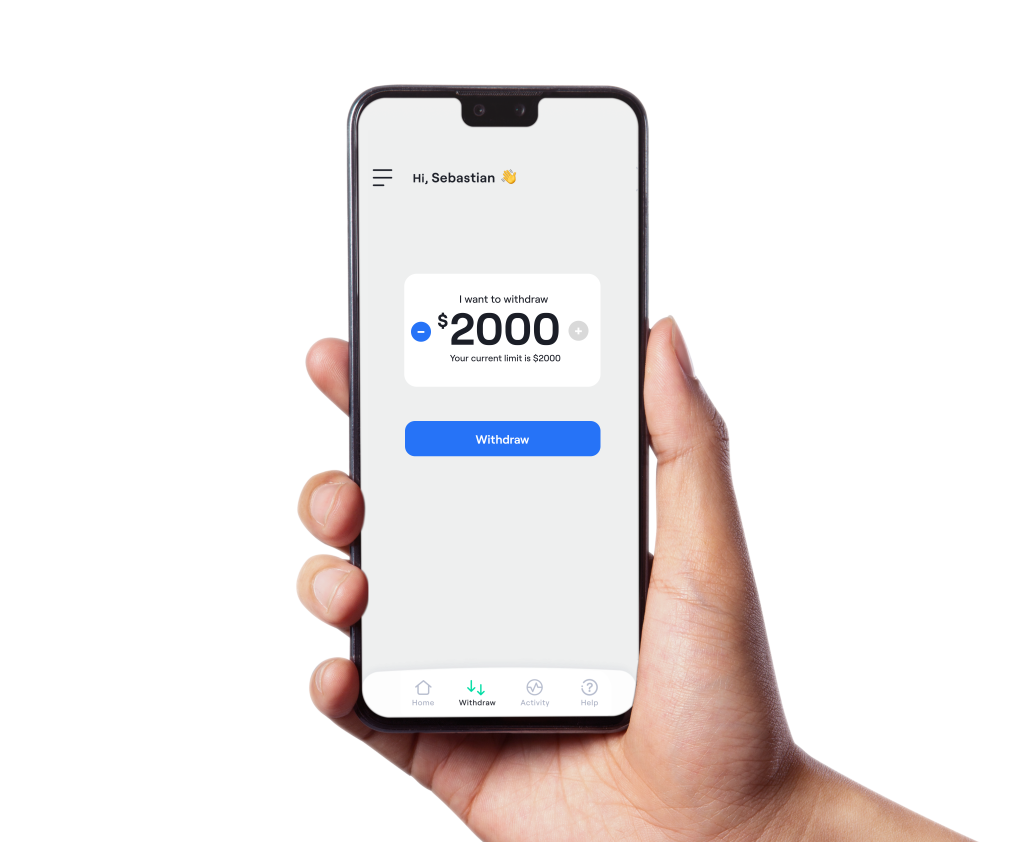

Instant Cash to Pay Your Bill

Wagetap gives you two convenient ways to pay your internet bill. The first option is our wage advance feature. With wage advance, you can get up to $500 of your wage early. You don’t have to wait until payday to get the cash you need. Simply submit your request and we’ll send you your cash instantly. No hidden fees or late fees. Just your money when you need it most.

Once payday comes around, you’ll receive the remainder of your wage. It’s that simple and takes no effort on your part. With instant cash, you can cover your internet bill and any other bill or expense that needs to be paid.

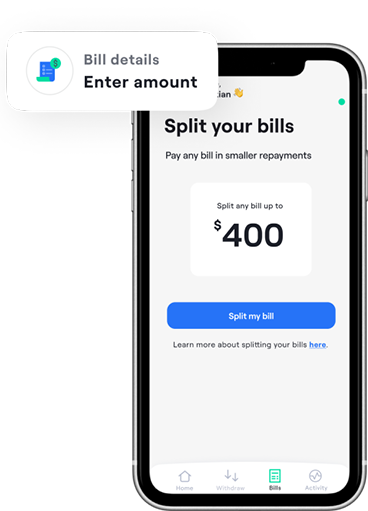

Spread Your Wi-Fi Costs into a Stress-free Payment Plan

Your other option to cover your Wi-Fi costs is with our bill-splitting feature. With bill split, you can spread your bill out into smaller, more manageable payments. Wagetap lets you cover up to $600 of your bill and repay it with a stress-free payment plan. If you borrow less than $300, your repayment will be split into three equal payments that line up with your payday. Borrowing more than $300 will split it up into four equal payments.

Internet Providers We Support

Wagetap makes paying your Wi-Fi bill as convenient as possible. Simply pay your internet provider directly in our app and cover your bills from there. You can pay any provider that offers BPAY as a payment option, including major Australian providers like Telstra, Optus, TPG and Vocus directly using Wagetap. You’ll never have to worry about missing a payment again.

Eligibility Requirements for Internet Bill Assistance

To use Wagetap, you will need to meet certain eligibility criteria. If your status changes, it is possible to lose access to our features. We will look at these criteria to determine if you can use our financial assistance features.

Here are the requirements that need to be met:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria.

Your eligibility is reassessed regularly to make sure you’re still able to use Wagetap.

Download Our App to Get Started!

Ready to make the monthly bill cycle less stressful? Paying your internet bill has never been easier or more manageable thanks to Wagetap. In addition to paying your Wi-Fi bill, you can also use Wagetap’s bill splitting features to help with utilities, Foxtel and more. You can also use our wage advance when you need some extra funds for groceries and other expenses. With Wagetap, you can have more financial security and take some of the stress out of budgeting each month. Download Wagetap today on the Apple App Store or Google Play Store. Setting up your account is quick and easy. Once you’re verified, you’ll get instant access to our features.

It’s Like Buy Now Pay Later But for Your Internet Bills

Wagetap works just like buy now pay later apps, but for your bills instead. When you use buy now pay later apps, you can cover shopping expenses on your favourite retailers. But when you use Wagetap, you can cover your necessary bills and make sure you have the important services you need for the month, like Wi-Fi and internet.

See why over 300k Australians love us

Bill Split

What is Bill Split?

How does Bill Split work?

- 1. Add a bill within your eligibility limit

- 2. We cover your bill for you

- 3. You make smaller repayments aligned to your payday.

How much does it cost to Bill Split?

How much of my bill can I pay with Wagetap?

What affects my eligibility to use Bill Split?

- • You have not connected a transacting account that your wages are deposited. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Centrelink makes up more than 50% of your wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

How long will it take for my bill to be paid?

How many split repayments will I need to make?

- • If your bill is less than $300, your bill will be split into 3 repayments.

- • If your bill is more than $300, your bill will be split into 4 repayments.

Can I use Bill Split and Wage Advance at the same time?

How many bills can I split at a time?

Will I get a receipt for my bill payment?

Why did the bill payment get rejected?

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd